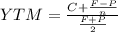

Suppose that ford issues a coupon bonds at a price of $1,000, which is the same as the bond's par value. assume the bond has a coupon rate of 4.5%, pays the coupon once per year, and has a maturity of 20 years. if an investor purchased this bond at the price of $1,000, for each year except the last year, the investor would receive a payment of 45. (round your answers to the nearest dollar) when the bond matures, t investor would receive a final payment of $1045. (round your answers to the nearest dollar.) now suppose the price of the bond changes to $1, 060. assuming an investor purchased the bond at a price of $1, 060, the investor would receive a current yield equal to ()

Answers: 1

Another question on Business

Business, 22.06.2019 10:20

The different concepts in the architecture operating model are aligned with how the business chooses to integrate and standardize with an enterprise solution. in the the technology solution shares data across the enterprise.

Answers: 3

Business, 22.06.2019 22:30

Experts are particularly concerned about four strategic metal resources that are important for the u.s. economy and military strength, and that must be imported. what percentage does the u.s. import? *

Answers: 2

Business, 23.06.2019 06:00

What are some questions to ask a clerk in the dispatch office?

Answers: 1

Business, 23.06.2019 10:00

The american dream includes home ownership. but in the last few years, it's gotten harder and harder to own a home. do you think home ownership is important to most americans today? why or why not?

Answers: 1

You know the right answer?

Suppose that ford issues a coupon bonds at a price of $1,000, which is the same as the bond's par va...

Questions

Social Studies, 20.07.2019 00:00

History, 20.07.2019 00:00

Social Studies, 20.07.2019 00:00

Mathematics, 20.07.2019 00:00

Biology, 20.07.2019 00:00

Social Studies, 20.07.2019 00:00

Social Studies, 20.07.2019 00:00

Social Studies, 20.07.2019 00:00