Business, 13.09.2019 01:30 killinit143

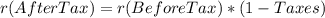

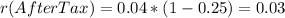

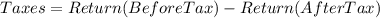

Jack has $1,000 to invest. he has a choice between municipal bonds with an interest rate of 4% or corporate bonds with an interest rate of 6%. jack has a marginal tax rate of 25%. given this information, jack should invest in the bonds. the after-tax rate of return on the municipal bonds is % and the after tax rate of return on the corporate bonds is %. the difference in the rates of return is known as taxes.

Answers: 3

Another question on Business

Business, 21.06.2019 22:50

The following data pertains to activity and costs for two months: june july activity level in 10,000 12,000 direct materials $16,000 $ ? fixed factory rent 12,000 ? manufacturing overhead 10,000 ? total cost $38,000 $42,900 assuming that these activity levels are within the relevant range, the manufacturing overhead for july was: a) $10,000 b) $11,700 c) $19,000 d) $9,300

Answers: 2

Business, 22.06.2019 14:30

Which of the following is an example of a positive externality? a. promoting generic drugs would benefit people. b. a lower inflation rate would benefit most consumers. c. compulsory flu shots for all students prevents the spread of illness in the general public. d. singapore has adopted a comprehensive savings plan for all workers known as the central provident fund.

Answers: 1

Business, 23.06.2019 11:00

The – effect means tommy's – will shift because he has less purchasing power. as a result, he may choose the regular-size steak instead of the larger "hunter's portion" he prefers. the – effect means tommy may spend some of the money he saved by ordering the smaller steak to order a bigger salad.

Answers: 3

You know the right answer?

Jack has $1,000 to invest. he has a choice between municipal bonds with an interest rate of 4% or co...

Questions

English, 04.04.2021 09:40

Physics, 04.04.2021 09:40

Mathematics, 04.04.2021 09:40

Mathematics, 04.04.2021 09:40

Advanced Placement (AP), 04.04.2021 09:40

Spanish, 04.04.2021 09:40

Geography, 04.04.2021 09:40

Mathematics, 04.04.2021 09:40

Mathematics, 04.04.2021 09:40

Mathematics, 04.04.2021 09:40

History, 04.04.2021 09:40

Chemistry, 04.04.2021 09:40