Business, 11.09.2019 04:30 lanipooh01

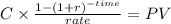

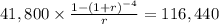

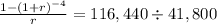

Wayne company is considering a long-term investment project called zip. zip will require an investment of $116,440. it will have a useful life of 4 years and no salvage value. annual revenues would increase by $80,900, and annual expenses (excluding depreciation) would increase by $39,100. wayne uses the straight-line method to compute depreciation expense. the company’s required rate of return is 19%. compute the annual rate of return. (round answer to 0 decimal places, e. g. 15%.) annual rate of return % determine whether the project is acceptable? the project.

Answers: 3

Another question on Business

Business, 22.06.2019 06:30

Individual consumers belong to which step of choosing a target market? possible customers competition demographics communication

Answers: 2

Business, 22.06.2019 08:00

Interest is credited to a fixed annuity no lower than the variable contract rate contract guaranteed rate current rate of inflation prime rate

Answers: 2

Business, 22.06.2019 21:30

Sunset foods relies on a highly centralized functional structure to ensure consistency in the quality and taste of its products and to drive down costs via process innovations. however, as a consequence of its highly compartmentalized structure, the firm has found it difficult to transfer information and ideas from one department to the next. with the launch of its new line of breakfast foods coming up, how can sunset improve its ability to collaborate without sacrificing the benefits of its current structure

Answers: 1

Business, 22.06.2019 22:20

With q7 assume the sweet company uses a plantwide predetermined overhead rate with machine-hours as the allocation base.and for q 10,11,13,and 14,assume that the company use department predetermined overhead rates with machine-hours as the allocation bade in both departements.7. assume that sweeten company used cost-plus pricing (and a markup percentage of 80% of total manufacturing cost) to establish selling prices for all of its jobs. what selling price would the company have established for jobs p and q? what are the selling prices for both jobs when stated on a per unit basis assuming 20 units were produced for job p and 30 units were produced for job q? (do not round intermediate calculations. round your final answers to nearest whole dollar.)total price for the job for job p -job q selling price per unit for job p q . how much manufacturing overhead was applied from the molding department to job p and how much was applied to job q? (do not round intermediate calculations.) job p job q manufacturing overhead applied for job p for job q . how much manufacturing overhead was applied from the fabrication department to job p and how much was applied to job q? (do not round intermediate calculations.)job p job q manufacturing overhead applied for job p for job q . if job q included 30 units, what was its unit product cost? (do not round intermediate calculations. round your final answer to nearest whole dollar.)14. assume that sweeten company used cost-plus pricing (and a markup percentage of 80% of total manufacturing cost) to establish selling prices for all of its jobs. what selling price would the company have established for jobs p and q? what are the selling prices for both jobs when stated on a per unit basis assuming 20 units were produced for job p and 30 units were produced for job q? (do not round intermediate calculations. round your final answer to nearest whole dollar.)total price for the job p for job q selling price per unit for job p for job q

Answers: 1

You know the right answer?

Wayne company is considering a long-term investment project called zip. zip will require an investme...

Questions

Mathematics, 21.01.2021 21:20

Mathematics, 21.01.2021 21:20

History, 21.01.2021 21:20

Mathematics, 21.01.2021 21:20

Mathematics, 21.01.2021 21:20

Social Studies, 21.01.2021 21:20

Social Studies, 21.01.2021 21:20

Mathematics, 21.01.2021 21:20

Mathematics, 21.01.2021 21:20

Mathematics, 21.01.2021 21:20

Biology, 21.01.2021 21:20

Mathematics, 21.01.2021 21:20

Mathematics, 21.01.2021 21:20

Social Studies, 21.01.2021 21:20