Business, 11.09.2019 01:30 mariah8926

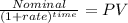

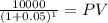

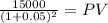

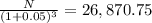

You are buying an investment product that costs $50,000 today. the annual interest rate is 5% and the investment period is 3 years. the investment will repay you $10,000 at the end of year 1 and $15,000 at the end of year 2. based on economic equivalent value of the investment, how much should you receive at the end of year 3? round the answer to the nearest integer. (e. g. round 10.25 to 10, round 10.78 to 11)

Answers: 1

Another question on Business

Business, 21.06.2019 19:40

Which of the following actions is most likely to result in a decrease in the money supply? a. the required reserve ratio for banks is decreased. b. the discount rate on overnight loans is lowered. c. the federal reserve bank buys treasury bonds. d. the government sells a new batch of treasury bonds. 2b2t

Answers: 1

Business, 22.06.2019 05:30

Suppose jamal purchases a pair of running shoes online for $60. if his state has a sales tax on clothing of 6 percent, how much is he required to pay in state sales tax?

Answers: 3

Business, 22.06.2019 19:40

You estimate that your cattle farm will generate $0.15 million of profits on sales of $3 million under normal economic conditions and that the degree of operating leverage is 2. (leave no cells blank - be certain to enter "0" wherever required. do not round intermediate calculations. enter your answers in millions.) a. what will profits be if sales turn out to be $1.5 million?

Answers: 3

Business, 22.06.2019 22:10

What is private equity investing? who participates in it and why? how is palamon positioned in the industry? how does private equity investing compare with public market investing? what are the similarities and differences between the two? why is palamon interested in teamsystem? does it fit with palamon’s investment strategy? how much is 51% of teamsystem’s common equity worth? use both a discounted cash flow and a multiple-based valuation to justify your recommendation. what complexities do cross-border deals introduce? what are the specific risks of this deal? what should louis elson recommend to his partners? is it a go or not? if it is a go, what nonprice terms are important? if it’s not a go, what counterproposal would you make?

Answers: 1

You know the right answer?

You are buying an investment product that costs $50,000 today. the annual interest rate is 5% and th...

Questions

English, 30.11.2020 20:10

Computers and Technology, 30.11.2020 20:10

Computers and Technology, 30.11.2020 20:10

Mathematics, 30.11.2020 20:10

Health, 30.11.2020 20:10

Biology, 30.11.2020 20:10

History, 30.11.2020 20:10

Mathematics, 30.11.2020 20:10

Medicine, 30.11.2020 20:10

Mathematics, 30.11.2020 20:10

Mathematics, 30.11.2020 20:10