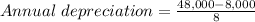

On january 1, 2016, jacob inc. purchased a commercial truck for $48,000 and uses the straight-line depreciation method. the truck has a useful life of eight years and an estimated residual value of $8,000. on december 31, 2017, jacob inc. sold the truck for $43,000. what amount of gain or loss should jacob inc. record on december 31, 2017?

a. gain, $22,000.

b. gain, $5,000.

c. loss, $3,000.

d. loss, $18,000.

Answers: 1

Another question on Business

Business, 22.06.2019 12:20

Over the past decade, brands that were once available only to the wealthy have created more affordable product extensions, giving a far broader range of consumers a taste of the good life. jaguar, for instance, launched its x-type sedan, which starts at $30,000 and is meant for the "almost rich" consumer who aspires to live in luxury. by marketing to people who desire a luxurious lifestyle, jaguar is using:

Answers: 3

Business, 22.06.2019 17:30

Jeanie had always been interested in how individuals and businesses effectively allocate their resources in order to accomplish personal and organizational goals. that’s why she majored in economics and took on an entry-level position at an accounting firm. she is very interested in further advancing her career by looking into a specialization that builds upon her academic background, and her interest in deepening her understanding of how companies adjust their operating results to incorporate the economic impacts of their practices on internal and external stakeholders. which specialization could jeanie follow to get the best of both worlds? jeanie should chose to get the best of both worlds.

Answers: 2

Business, 22.06.2019 19:30

Quick calculate the roi dollar amount and percentage for these example investments. a. you invest $50 in a government bond that says you can redeem it a year later for $55. use the instructions in lesson 3 to calculate the roi dollar amount and percentage. (3.0 points) tip: subtract the initial investment from the total return to get the roi dollar amount. then divide the roi dollar amount by the initial investment, and multiply that number by 100 to get the percentage. b. you invest $200 in stocks and sell them one year later for $230. use the instructions in lesson 3 to calculate the roi dollar amount and percentage. (3.0 points) tip: subtract the initial investment from the total return to get the roi dollar amount. then divide the roi dollar amount by the initial investment, and multiply that number by 100 to get the percentage.

Answers: 2

Business, 23.06.2019 02:20

Which one of the following is not a typical current liability? a. interest payable b. current maturities of long-term debt c. salaries payable d. mortgages payable

Answers: 3

You know the right answer?

On january 1, 2016, jacob inc. purchased a commercial truck for $48,000 and uses the straight-line d...

Questions

Social Studies, 02.03.2020 06:35

Mathematics, 02.03.2020 06:36

Physics, 02.03.2020 06:36

Mathematics, 02.03.2020 06:36

Advanced Placement (AP), 02.03.2020 06:36

Mathematics, 02.03.2020 06:36

Mathematics, 02.03.2020 06:36

Mathematics, 02.03.2020 06:36