Business, 10.09.2019 22:30 BreBreDoeCCx

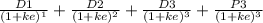

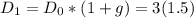

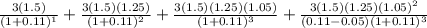

Assume that the average firm in your company's industry is expected to grow at a constant rate of 5% and that its dividend yield is 6%. your company is about as risky as the average firm in the industry and just paid a dividend (d0) of $3. you expect that the growth rate of dividends will be 50% during the first year (g0,1 = 50%) and 25% during the second year (g1,2 = 25%). after year 2, dividend growth will be constant at 5%. what is the required rate of return on your company’s stock? what is the estimated value per share of your firm’s stock? do not round intermediate calculations. round the monetary value to the nearest cent and percentage value to the nearest whole number.

Answers: 2

Another question on Business

Business, 21.06.2019 19:40

Your mother's well-diversified portfolio has an expected return of 12.0% and a beta of 1.20. she is in the process of buying 100 shares of safety corp. at $10 a share and adding it to her portfolio. safety has an expected return of 15.0% and a beta of 2.00. the total value of your current portfolio is $9,000. what will the expected return and beta on the portfolio be after the purchase of the safety stock?

Answers: 3

Business, 22.06.2019 06:40

Depreciation on the company's equipment for 2017 is computed to be $18,000.the prepaid insurance account had a $6,000 debit balance at december 31, 2017, before adjusting for the costs of any expired coverage. an analysis of the company's insurance policies showed that $1,100 of unexpired insurance coverage remains.the office supplies account had a $700 debit balance on december 31, 2016; and $3,480 of office supplies were purchased during the year. the december 31, 2017, physical count showed $300 of supplies available.two-thirds of the work related to $15,000 of cash received in advance was performed this period.the prepaid insurance account had a $6,800 debit balance at december 31, 2017, before adjusting for the costs of any expired coverage. an analysis of insurance policies showed that $5,800 of coverage had expired.wage expenses of $3,200 have been incurred but are not paid as of december 31, 2017.

Answers: 3

Business, 22.06.2019 09:40

Boone brothers remodels homes and replaces windows. ace builders constructs new homes. if boone brothers considers expanding into new home construction, it should evaluate the expansion project using which one of the following as the required return for the project?

Answers: 1

Business, 22.06.2019 09:40

Microsoft's stock price peaked at 6118% of its ipo price more than 13 years after the ipo suppose that $10,000 invested in microsoft at its ipo price had been worth $600,000 (6000% of the ipo price) after exactly 13 years. what interest rate, compounded annually, does this represent? (round your answer to two decimal places.)

Answers: 1

You know the right answer?

Assume that the average firm in your company's industry is expected to grow at a constant rate of 5%...

Questions

Mathematics, 11.10.2019 23:30

Social Studies, 11.10.2019 23:30

Chemistry, 11.10.2019 23:30

English, 11.10.2019 23:30

Mathematics, 11.10.2019 23:30

Social Studies, 11.10.2019 23:30

Social Studies, 11.10.2019 23:30

Social Studies, 11.10.2019 23:30

Mathematics, 11.10.2019 23:30

. If ke is made subject of formular,

. If ke is made subject of formular,  .

. .

.

= 88.51

= 88.51