Business, 09.09.2019 22:20 connermichaela

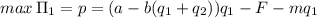

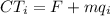

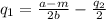

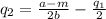

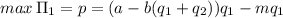

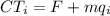

In the initial cournot duopoly equilibrium, both firms have constant marginal costs, m, and no fixed costs, and there is a barrier to entry. show what happens to the best-response function of firms if both firms now face a fixed cost of f let market demand be p-a -bq, where a and b are positive parameters with 2 firms. let q1 and q2 be the amount produced by firm 1 and firm 2, respectively. assuming it is optimal for the firm one to produce, its best-response function is i. (properly format your expression using the tools in the palette. hover over tools to see keyboard shortcuts. eg., a subscript can be created with the- q1 = character.)

Answers: 1

Another question on Business

Business, 21.06.2019 17:30

Which of the following best describes biochemical evidence that would not support the modern concept of evolution? a. a bacterium that uses inorganic materials to produce energy b. an organism that does not undergo cellular respiration c. a species of bacteria that is capable of photosynthesis d. an organism that undergoes both aerobic and anaerobic respiration

Answers: 2

Business, 21.06.2019 18:10

Grace period is a period of time before the credit card company starts charging late fees.truefalse

Answers: 1

Business, 22.06.2019 20:20

Faldo corp sells on terms that allow customers 45 days to pay for merchandise. its sales last year were $325,000, and its year-end receivables were $60,000. if its dso is less than the 45-day credit period, then customers are paying on time. otherwise, they are paying late. by how much are customers paying early or late? base your answer on this equation: dso - credit period = days early or late, and use a 365-day year when calculating the dso. a positive answer indicates late payments, while a negative answer indicates early payments.a. 21.27b. 22.38c. 23.50d. 24.68e. 25.91b

Answers: 2

Business, 22.06.2019 22:40

Johnson company uses the allowance method to account for uncollectible accounts receivable. bad debt expense is established as a percentage of credit sales. for 2018, net credit sales totaled $6,400,000, and the estimated bad debt percentage is 1.40%. the allowance for uncollectible accounts had a credit balance of $61,000 at the beginning of 2018 and $49,500, after adjusting entries, at the end of 2018.required: 1. what is bad debt expense for 2018 as a percent of net credit sales? 2. assume johnson makes no other adjustment of bad debt expense during 2018. determine the amount of accounts receivable written off during 2018.3. if the company uses the direct write-off method, what would bad debt expense be for 2018?

Answers: 1

You know the right answer?

In the initial cournot duopoly equilibrium, both firms have constant marginal costs, m, and no fixed...

Questions

Mathematics, 05.05.2021 01:40

Biology, 05.05.2021 01:40

Chemistry, 05.05.2021 01:40

Mathematics, 05.05.2021 01:40

History, 05.05.2021 01:40

Mathematics, 05.05.2021 01:40

Mathematics, 05.05.2021 01:40

English, 05.05.2021 01:40

Mathematics, 05.05.2021 01:40

Mathematics, 05.05.2021 01:40

is the total production

is the total production

are given by

are given by

for i=1,2

for i=1,2