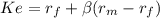

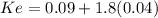

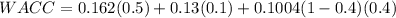

Gul corp. considers the following capital structure optimal: 40% debt; 50% equity; and 10% preferred stock. gul’s stock currently sells for $50 per share. gul’s beta is 1.8. the risk-free rate is 9 percent and the expected market return is 13 percent. gul’s bond currently sells in the market for $1150. the bond carries an annual coupon payment of 12 % of the face value which is paid in two semiannual payments. the bond will mature in 15 years and its face value is $1000. the bond's annual yield to maturiy is 10.04%. the firm’s marginal tax rate is 40 percent. the gul’s required return on the preferred stock is 13%. find the firm’s overall cost of capital (wacc).

Answers: 1

Another question on Business

Business, 22.06.2019 01:20

For a multistate lottery, the following probability distribution represents the cash prizes of the lottery with their corresponding probabilities. complete parts (a) through (c) below. x (cash prize, $) p(x) grand prizegrand prize 0.000000008860.00000000886 200,000 0.000000390.00000039 10,000 0.0000016950.000001695 100 0.0001582930.000158293 7 0.0039114060.003911406 4 0.0080465690.008046569 3 0.012865710.01286571 0 0.975015928140.97501592814 (a) if the grand prize is $13 comma 000 comma 00013,000,000, find and interpret the expected cash prize. if a ticket costs $1, what is your expected profit from one ticket? the expected cash prize is $nothing.

Answers: 3

Business, 22.06.2019 11:40

If kroger had whole foods’ number of days’ sales in inventory, how much additional cash flow would have been generated from the smaller inventory relative to its actual average inventory position? round interim calculations to one decimal place and your final answer to the nearest million.

Answers: 2

Business, 22.06.2019 18:10

Ashop owner uses a reorder point approach to restocking a certain raw material. lead time is six days. usage of the material during lead time is normally distributed with a mean of 42 pounds and a standard deviation of four pounds. when should the raw material be reordered if the acceptable risk of a stockout is 3 percent?

Answers: 1

Business, 22.06.2019 19:20

Advertisers are usually very conscious of their audience. choose an issue of a popular magazine such as time, sports illustrated, vanity fair, rolling stone, or the like. from that issue select three advertisements to analyze. try to determine the audience being appealed to in each advertisement and analyze the appeals used to persuade buyers. how might the appeals differ is the ads were designed to persuade a different audience.

Answers: 2

You know the right answer?

Gul corp. considers the following capital structure optimal: 40% debt; 50% equity; and 10% prefer...

Questions

Mathematics, 19.09.2019 03:00

Biology, 19.09.2019 03:00

History, 19.09.2019 03:00

Biology, 19.09.2019 03:00

Computers and Technology, 19.09.2019 03:00

English, 19.09.2019 03:00

Biology, 19.09.2019 03:00

Business, 19.09.2019 03:00

Mathematics, 19.09.2019 03:00

Biology, 19.09.2019 03:00

English, 19.09.2019 03:00

Biology, 19.09.2019 03:00

Health, 19.09.2019 03:00