Business, 06.09.2019 21:10 hebrew1148

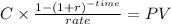

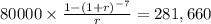

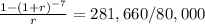

Bau long-haul, inc., is considering the purchase of a tractor-trailer that would cost $281,660, would have a useful life of 7 years, and would have no salvage value. the tractor-trailer would be used in the company's hauling business, resulting in additional net cash inflows of $80,000 per year. the internal rate of return on the investment in the tractor-trailer is closest to (ignore income taxes.):

Answers: 2

Another question on Business

Business, 22.06.2019 09:40

Newton industries is considering a project and has developed the following estimates: unit sales = 4,800, price per unit = $67, variable cost per unit = $42, annual fixed costs = $11,900. the depreciation is $14,700 a year and the tax rate is 34 percent. what effect would an increase of $1 in the selling price have on the operating cash flow?

Answers: 2

Business, 23.06.2019 02:30

George retired from a local law firm and then volunteered to oversee a nonprofit's legal records. george is performing the duties of a:

Answers: 1

Business, 23.06.2019 08:50

Walking through the grocery store, ramon sees a "buy 2, get 1 free" deal on laundry detergent. even though he currently has plenty of detergent he decides to take home all three bottles. ramon's decision seems to have been based mostly on his immediate need for the detergent the low price of alternative brands the limited income he presently earns the sale price offered for the detergent

Answers: 1

You know the right answer?

Bau long-haul, inc., is considering the purchase of a tractor-trailer that would cost $281,660, woul...

Questions

Mathematics, 25.02.2021 06:20

Mathematics, 25.02.2021 06:20

Mathematics, 25.02.2021 06:20

History, 25.02.2021 06:20

Mathematics, 25.02.2021 06:20

History, 25.02.2021 06:20

Chemistry, 25.02.2021 06:20

Mathematics, 25.02.2021 06:20

History, 25.02.2021 06:20

Mathematics, 25.02.2021 06:20

Biology, 25.02.2021 06:20

Mathematics, 25.02.2021 06:20

Social Studies, 25.02.2021 06:20

Mathematics, 25.02.2021 06:20