Business, 02.09.2019 20:20 navypeanut

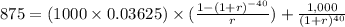

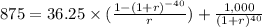

He stock is currently selling for $15.25 per share, and its noncallable $1,000 par value, 20-year, 7.25% bonds with semiannual payments are selling for $875.00. the beta is 1.25, the yield on a 6-month treasury bill is 3.50%, and the yield on a 20-year treasury bond is 5.50%. the required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years. the firm's tax rate is 40%. what is the best estimate of the after-tax cost of debt?

Answers: 2

Another question on Business

Business, 22.06.2019 06:00

For 2018, rahal's auto parts estimates bad debt expense at 1% of credit sales. the company reported accounts receivable and an allowance for uncollectible accounts of $86,500 and $2,100, respectively, at december 31, 2017. during 2018, rahal's credit sales and collections were $404,000 and $408,000, respectively, and $2,340 in accounts receivable were written off.rahal's accounts receivable at december 31, 2018, are:

Answers: 2

Business, 22.06.2019 13:30

You operate a small advertising agency. you employ two secretaries, a graphic designer, three sales representatives, and an office coordinator. 1. what types of things would you consider when determining how to compensate each position? describe two (2) considerations. 2. what type of compensation plan would you use for each position?

Answers: 1

Business, 22.06.2019 19:10

According to the textbook chapter, “the emotional connection of distinguishing differences and conflict”, which of the following groups of terms describes best the skills/resources that managers need when managing differences in their organization? energy, commitment, tolerance, and appreciation energy, adequate funding, tolerance, and appreciation funding, tolerance, a strong hr department, and tolerance energy, a strong hr department, patience, and strong leadership skills

Answers: 3

Business, 22.06.2019 19:20

The following information is from the 2019 records of albert book shop: accounts receivable, december 31, 2019 $ 42 comma 000 (debit) allowance for bad debts, december 31, 2019 prior to adjustment 2 comma 000 (debit) net credit sales for 2019 179 comma 000 accounts written off as uncollectible during 2017 15 comma 000 cash sales during 2019 28 comma 500 bad debts expense is estimated by the method. management estimates that $ 5 comma 300 of accounts receivable will be uncollectible. calculate the amount of bad debts expense for 2019.

Answers: 2

You know the right answer?

He stock is currently selling for $15.25 per share, and its noncallable $1,000 par value, 20-year, 7...

Questions

Mathematics, 22.10.2019 19:00

Mathematics, 22.10.2019 19:00

Mathematics, 22.10.2019 19:00

History, 22.10.2019 19:00

Chemistry, 22.10.2019 19:00

Computers and Technology, 22.10.2019 19:00

Mathematics, 22.10.2019 19:00

Chemistry, 22.10.2019 19:00

Mathematics, 22.10.2019 19:00

Physics, 22.10.2019 19:00