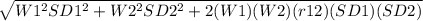

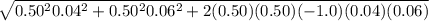

Consider the following data on returns (r), standard deviation weights (w), and correlations (r) for two stocks: r1 = 10%, ? 1 = 4%, r2 = 20%, ? 2 = 6%, r12 = -1.0, w1=0.50, w2=0.50what is the standard deviation of a portfolio of stocks 1 and 2 with the above weights? 1. 1.0%2. 1.10%3. 10%4. none of the given answers is correct.5. 0.20%

Answers: 1

Another question on Business

Business, 22.06.2019 02:30

Based on the supply and demand theory, why do medical doctors earn higher wages than child-care workers?

Answers: 1

Business, 22.06.2019 10:00

Your father offers you a choice of $120,000 in 11 years or $48,500 today. use appendix b as an approximate answer, but calculate your final answer using the formula and financial calculator methods. a-1. if money is discounted at 11 percent, what is the present value of the $120,000?

Answers: 3

Business, 22.06.2019 11:30

12. to produce a textured purée, you would use a/an a. food processor. b. wide-mesh sieve. c. immersion blender d. food mill. student a incorrect which is correct answer?

Answers: 2

Business, 22.06.2019 20:00

Describe a real or made-up but possible example of a situation where an employee faces a conflict of interest. explain at least two things the company could do to make sure the employee won't be tempted into unethical behavior by that conflict of interest. (3.0 points)

Answers: 3

You know the right answer?

Consider the following data on returns (r), standard deviation weights (w), and correlations (r) fo...

Questions

Computers and Technology, 01.08.2019 03:30

Mathematics, 01.08.2019 03:30

Mathematics, 01.08.2019 03:30

History, 01.08.2019 03:30

History, 01.08.2019 03:30

Mathematics, 01.08.2019 03:30

Mathematics, 01.08.2019 03:30

History, 01.08.2019 03:30

Spanish, 01.08.2019 03:30