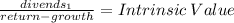

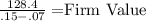

If the expected long-run growth rate for this stock is free cash flow during the just-ended year (t = 0) was $120 million, and fcf is expected to grow at a constant rate of 7% in the future. if the weighted average cost of capital is 15%, what is the firm's value of operations, in millions? 5%, and if investors' required rate of return is 11.5%, what is the current stock price?

Answers: 1

Another question on Business

Business, 21.06.2019 15:30

What is "staffing level"? a) the practice of assigning the same number of workers to each department b) the average educational level attained by employees of a business c) the rank above cashier d) the number of workers assigned to jobs at a particular time

Answers: 2

Business, 22.06.2019 10:30

You meet that special person and get married. amazingly your spouse has exactly the same income you do 47,810. if your tax status is now married filing jointly what is your tax liability

Answers: 2

Business, 22.06.2019 11:00

How did the contribution of the goods producing sector to gdp growth change between 2010 and 2011 a. it fell by 0.3%. b. it fell by 2.3%. c. it rose by 2.3%. d. it rose by 0.6%. the answer is b

Answers: 1

Business, 22.06.2019 22:30

Rahm's credit card issuer calculates interest based on the outstanding balance at the end of the last billing period. what is this method of calculating interest on a credit card called?

Answers: 2

You know the right answer?

If the expected long-run growth rate for this stock is free cash flow during the just-ended year (t...

Questions

Mathematics, 19.10.2021 02:00

Computers and Technology, 19.10.2021 02:00

Mathematics, 19.10.2021 02:00

History, 19.10.2021 02:00

Physics, 19.10.2021 02:00

History, 19.10.2021 02:00

History, 19.10.2021 02:00

Biology, 19.10.2021 02:00