Business, 20.08.2019 20:30 carterlapere

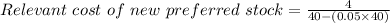

Tempo corp. will issue preferred stock to finance a new artillery line. the firm's existing preferred stock pays a dividend of $4.00 per share and is selling for $40 per share. investment bankers have advised tempo that flotation costs on the new preferred issue would be 5% of the selling price. tempo's marginal tax rate is 30%. what is the relevant cost of new preferred stock? a) 7.00%b) 7.37%c) 10.00%d) 10.53%e) 15.00%

Answers: 1

Another question on Business

Business, 22.06.2019 05:30

Financial information that is capable of making a difference in a decision is

Answers: 3

Business, 22.06.2019 06:30

Select all that apply. select the ways that labor unions can increase wages. collective bargaining reducing the labor supply increasing the demand for labor creating monopolies

Answers: 1

Business, 22.06.2019 21:00

Suppose either computers or televisions can be assembled with the following labor inputs: units produced 1 2 3 4 5 6 7 8 9 10 total labor used 3 7 12 18 25 33 42 54 70 90 (a) draw the production possibilities curve for an economy with 54 units of labor. label it p54. (b) what is the opportunity cost of the eighth computer? (c) suppose immigration brings in 36 more workers. redraw the production possibilities curve to reflect this added labor. label the new curve p90.

Answers: 2

You know the right answer?

Tempo corp. will issue preferred stock to finance a new artillery line. the firm's existing preferre...

Questions

Chemistry, 25.05.2021 08:50

Mathematics, 25.05.2021 08:50

Arts, 25.05.2021 08:50

Mathematics, 25.05.2021 08:50

Mathematics, 25.05.2021 08:50

Mathematics, 25.05.2021 08:50

Mathematics, 25.05.2021 08:50

Mathematics, 25.05.2021 08:50

English, 25.05.2021 08:50

English, 25.05.2021 08:50

Mathematics, 25.05.2021 08:50

Mathematics, 25.05.2021 08:50