Answers: 3

Another question on Business

Business, 22.06.2019 09:30

Which are the best examples of costs that should be considered when creating a project budget?

Answers: 2

Business, 22.06.2019 11:00

When using various forms of promotion to carry the promotion message, it is important that the recipients of the message interpret it in the same way. creating a unified promotional message, where potential customers perceive the same message, whether it is in a tv commercial, or on a billboard, or in a blog, is called

Answers: 2

Business, 22.06.2019 12:50

Demand increases by less than supply increases. as a result, (a) equilibrium price will decline and equilibrium quantity will rise. (b) both equilibrium price and quantity will decline. (c) both equilibrium price and quantity will rise

Answers: 3

Business, 22.06.2019 14:30

Amethod of allocating merchandise cost that assumes the first merchandise bought was the first merchandise sold is called the a. last-in, first-out method. b. first-in, first-out method. c. specific identification method. d. average cost method.

Answers: 3

You know the right answer?

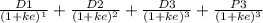

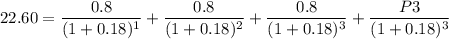

Mason holdings is expected to pay dividends of $.20 every quarter for the next three years. if the c...

Questions

Mathematics, 25.01.2021 23:00

History, 25.01.2021 23:00

Mathematics, 25.01.2021 23:00

Mathematics, 25.01.2021 23:00

Spanish, 25.01.2021 23:00

Chemistry, 25.01.2021 23:00

History, 25.01.2021 23:00

Chemistry, 25.01.2021 23:00

Geography, 25.01.2021 23:00

Mathematics, 25.01.2021 23:00

Mathematics, 25.01.2021 23:00

Mathematics, 25.01.2021 23:00

SAT, 25.01.2021 23:00

Mathematics, 25.01.2021 23:00

Arts, 25.01.2021 23:00

.

. .

.