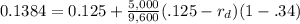

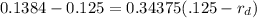

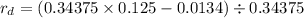

Aspen's distributors has a levered cost of equity of 13.84 percent and an unlevered cost of capital of 12.5 percent. the company has $5,000 in debt that is selling at par. the levered value of the firm is $14,600 and the tax rate is 34 percent. what is the pretax cost of debt?

Answers: 2

Another question on Business

Business, 22.06.2019 08:30

What is the equity method balance in the investment in lindman account at the end of 2018?

Answers: 2

Business, 22.06.2019 09:40

You plan to invest some money in a bank account. which of the following banks provides you with the highest effective rate of interest? hint: perhaps this problem requires some calculations. bank 1; 6.1% with annual compounding. bank 2; 6.0% with monthly compounding. bank 3; 6.0% with annual compounding. bank 4; 6.0% with quarterly compounding. bank 5; 6.0% with daily (365-day) compounding.

Answers: 3

Business, 22.06.2019 10:10

Ursus, inc., is considering a project that would have a five-year life and would require a $1,650,000 investment in equipment. at the end of five years, the project would terminate and the equipment would have no salvage value. the project would provide net operating income each year as follows (ignore income taxes.):

Answers: 1

You know the right answer?

Aspen's distributors has a levered cost of equity of 13.84 percent and an unlevered cost of capital...

Questions

Mathematics, 11.11.2019 19:31

Chemistry, 11.11.2019 19:31

Mathematics, 11.11.2019 19:31

History, 11.11.2019 19:31

Mathematics, 11.11.2019 19:31

Mathematics, 11.11.2019 19:31