Business, 02.08.2019 16:10 jnsoccerboy7260

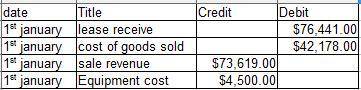

On january 1, year 1, manlier inc. leased equipment costing $45,000 to one of its customers. the sales-type lease agreement specifies six annual payments of $15,000 beginning on that date. the present value of the annual lease payments is $73,619. at the end of the lease, the equipment will be returned to manlier and is expected to have a residual value of $5,000. the present value of that residual value is $2,822. complete the appropriate journal entry recorded by manlier at the beginning of the lease. (if no entry is required for a transaction/event, select "no journal entry required" in the first account field. round your answers to the nearest whole number.)

Answers: 2

Another question on Business

Business, 22.06.2019 05:20

142"what is the value of n? soefon11402bebe99918+19: 00esseeshop60-990 0esle

Answers: 1

Business, 22.06.2019 10:50

Jen left a job paying $75,000 per year to start her own florist shop in a building she owns. the market value of the building is $120,000. she pays $35,000 per year for flowers and other supplies, and has a bank account that pays 5 percent interest. what is the economic cost of jen's business?

Answers: 3

Business, 22.06.2019 16:00

Winners of the georgia lotto drawing are given the choice of receiving the winning amount divided equally over 2121 years or as a lump-sum cash option amount. the cash option amount is determined by discounting the annual winning payment at 88% over 2121 years. this week the lottery is worth $1616 million to a single winner. what would the cash option payout be?

Answers: 3

You know the right answer?

On january 1, year 1, manlier inc. leased equipment costing $45,000 to one of its customers. the sal...

Questions

Computers and Technology, 29.08.2019 01:30

Computers and Technology, 29.08.2019 01:30

History, 29.08.2019 01:30

Physics, 29.08.2019 01:30

Social Studies, 29.08.2019 01:30

Computers and Technology, 29.08.2019 01:30

Mathematics, 29.08.2019 01:30

Spanish, 29.08.2019 01:30

Chemistry, 29.08.2019 01:30

Mathematics, 29.08.2019 01:30

Mathematics, 29.08.2019 01:30

French, 29.08.2019 01:30