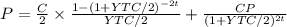

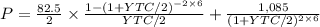

Keenan industries has a bond outstanding with 15 years to maturity, an 8.25% nominal coupon, semiannual payments, and a $1,000 par value. the bond has a 6.50% nominal yield to maturity, but it can be called in 6 years at a price of $1,085. what is the bonds nominal yield to call? which is an investor that buys the bond today more likely to earn?

Answers: 3

Another question on Business

Business, 22.06.2019 07:30

Why has the free enterprise system been modified to include some government intervention?

Answers: 1

Business, 22.06.2019 23:20

Warby parker, a manufacturer of fashionable prescription eyewear, notes on its website, "warby parker was founded with a rebellious spirit and a loft objective: to offer designer eyewear at a revolutionary price, while leading the way for socially-conscious business." this excerpt from the company's website states warby parker's

Answers: 1

Business, 22.06.2019 23:30

Miller company’s most recent contribution format income statement is shown below: total per unit sales (20,000 units) $300,000 $15.00 variable expenses 180,000 9.00 contribution margin 120,000 $6.00 fixed expenses 70,000 net operating income $ 50,000 required: prepare a new contribution format income statement under each of the following conditions (consider each case independently): (do not round intermediate calculations. round your "per unit" answers to 2 decimal places.) 1. the number of units sold increases by 15%.

Answers: 1

You know the right answer?

Keenan industries has a bond outstanding with 15 years to maturity, an 8.25% nominal coupon, semiann...

Questions

Mathematics, 03.02.2021 18:40

Mathematics, 03.02.2021 18:40

Biology, 03.02.2021 18:40

History, 03.02.2021 18:40

Business, 03.02.2021 18:40

Social Studies, 03.02.2021 18:40

English, 03.02.2021 18:40

Mathematics, 03.02.2021 18:40

Biology, 03.02.2021 18:40

Mathematics, 03.02.2021 18:40

Mathematics, 03.02.2021 18:40