Business, 16.07.2019 20:30 milkshakegrande101

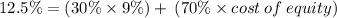

Pearson motors has a target capital structure of 30% debt and 70% common equity, with no preferred stock. the yield to maturity on the company's outstanding bonds is 12%, and its tax rate is 25%. pearson's cfo estimates that the company's wacc is 12.50%. what is pearson's cost of common equity? do not round intermediate calculations. round your answer to two decimal places.

Answers: 1

Another question on Business

Business, 22.06.2019 09:00

Asap describe three different expenses associated with restaurants. choose one of these expenses, and discuss how a manager could handle this expense.

Answers: 1

Business, 22.06.2019 10:10

An investment offers a total return of 18 percent over the coming year. janice yellen thinks the total real return on this investment will be only 14 percent. what does janice believe the inflation rate will be over the next year?

Answers: 3

Business, 22.06.2019 18:00

When peter metcalf describes black diamond’s manufacturing facility in china as a “greenfield project,” he means that partnered with a chinese company to buy the plant . of all market entry strategies, this one carries the lowest risk. because black diamond manufactures its outdoor sports products outside the united states, what risks must its managers be aware of?

Answers: 1

You know the right answer?

Pearson motors has a target capital structure of 30% debt and 70% common equity, with no preferred s...

Questions