Business, 16.07.2019 17:20 jforeman42

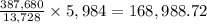

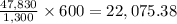

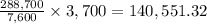

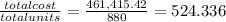

Mahaley, inc., manufactures and sells two products: product q9 and product f0. data concerning the expected production of each product and the expected total direct labor-hours (dlhs) required to produce that output appear below: expected production direct labor-hours per unit total direct labor-hours product q9 880 8.8 7,744 product f0 880 6.8 5,984 total direct labor-hours 13,728 the direct labor rate is $22.60 per dlh. the direct materials cost per unit for each product is given below: direct materials cost per unit product q9 $175.70 product f0 $147.50 the company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity: estimated expected activity activity cost pools activity measures overhead cost product q9 product f0 total labor-related dlhs $ 387,680 7,744 5,984 13,728 machine setups setups 47,830 700 600 1,300 order size mhs 288,700 3,900 3,700 7,600 $ 724,210 the unit product cost of product f0 under activity-based costing is closest to: (round your intermediate calculations to 2 decimal places.)

Answers: 2

Another question on Business

Business, 22.06.2019 13:40

Salge inc. bases its manufacturing overhead budget on budgeted direct labor-hours. the variable overhead rate is $8.10 per direct labor-hour. the company's budgeted fixed manufacturing overhead is $74,730 per month, which includes depreciation of $20,670. all other fixed manufacturing overhead costs represent current cash flows. the direct labor budget indicates that 5,300 direct labor-hours will be required in september. the company recomputes its predetermined overhead rate every month. the predetermined overhead rate for september should be:

Answers: 3

Business, 22.06.2019 14:50

Pear co.’s income statement for the year ended december 31, as prepared by pear’s controller, reported income before taxes of $125,000. the auditor questioned the following amounts that had been included in income before taxes: equity in earnings of cinn co. $ 40,000 dividends received from cinn 8,000 adjustments to profits of prior years for arithmetical errors in depreciation (35,000) pear owns 40% of cinn’s common stock, and no acquisition differentials are relevant. pear’s december 31 income statement should report income before taxes of

Answers: 3

Business, 22.06.2019 16:30

Which of the following has the largest impact on opportunity cost

Answers: 2

Business, 22.06.2019 18:00

During the holiday season, maria's department store works with a contracted employment agency to bring extra workers on board to handle overflow business, and extra duties such as wrapping presents. maria's is using during these rush times.

Answers: 3

You know the right answer?

Mahaley, inc., manufactures and sells two products: product q9 and product f0. data concerning the...

Questions

Mathematics, 05.07.2019 08:30

Biology, 05.07.2019 08:30

Geography, 05.07.2019 08:30

Mathematics, 05.07.2019 08:30

History, 05.07.2019 08:30

Chemistry, 05.07.2019 08:30

Geography, 05.07.2019 08:30

Geography, 05.07.2019 08:30

Geography, 05.07.2019 08:30

Geography, 05.07.2019 08:30

Mathematics, 05.07.2019 08:30