Business, 16.07.2019 03:20 giajramosp2r5da

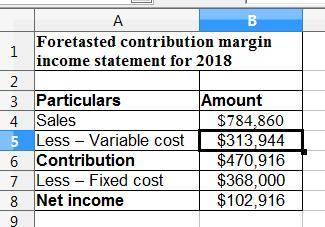

Astro co. sold 20,600 units of its only product and incurred a $55,028 loss (ignoring taxes) for the current year as shown here. during a planning session for year 2018’s activities, the production manager notes that variable costs can be reduced 50% by installing a machine that automates several operations. to obtain these savings, the company must increase its annual fixed costs by $156,000. the maximum output capacity of the company is 40,000 units per year. astro company contribution margin income statement for year ended december 31, 2017 sales $ 784,860 variable costs 627,888 contribution margin 156,972 fixed costs 212,000 net loss $ (55,028 ) prepare a forecasted contribution margin income statement for 2018 that shows the expected results with the machine installed. assume that the unit selling price and the number of units sold will not change, and no income taxes will be due.

Answers: 1

Another question on Business

Business, 22.06.2019 01:00

You are the manager in charge of global operations at bankglobal – a large commercial bank that operates in a number of countries around the world. you must decide whether or not to launch a new advertising campaign in the u.s. market. your accounting department has provided the accompanying statement, which summarizes the financial impact of the advertising campaign on u.s. operations. in addition, you recently received a call from a colleague in charge of foreign operations, and she indicated that her unit would lose $8 million if the u.s. advertising campaign were launched. your goal is to maximize bankglobal’s value. should you launch the new campaign? explain. pre-advertising campaign post-advertising campaign total revenues $18,610,900 $31,980,200 variable cost tv airtime 5,750,350 8,610,400 ad development labor 1,960,580 3,102,450 total variable costs 7,710,930 11,712,850 direct fixed cost depreciation – computer equipment 1,500,000 1,500,000 total direct fixed cost 1,500,000 1,500,000 indirect fixed cost managerial salaries 8,458,100 8,458,100 office supplies 2,003,500 2,003,500 total indirect fixed cost $10,461,600 $10,461,600

Answers: 2

Business, 22.06.2019 04:40

Dahlia enterprises needs someone to supply it with 127,000 cartons of machine screws per year to support its manufacturing needs over the next five years, and you’ve decided to bid on the contract. it will cost you $940,000 to install the equipment necessary to start production; you’ll depreciate this cost straight-line to zero over the project’s life. you estimate that in five years, this equipment can be salvaged for $77,000. your fixed production costs will be $332,000 per year, and your variable production costs should be $11.00 per carton. you also need an initial investment in net working capital of $82,000. if your tax rate is 30 percent and your required return is 11 percent on your investment, what bid price should you submit? (do not round intermediate calculations and round your final answer to 2 decimal places. (e.g., 32.16))

Answers: 3

Business, 22.06.2019 10:30

Factors like the unemployment rate, the stock market, global trade, economic policy, and the economic situation of other countries have no influence on the financial status of individuals. ( t or f)

Answers: 1

You know the right answer?

Astro co. sold 20,600 units of its only product and incurred a $55,028 loss (ignoring taxes) for the...

Questions

Social Studies, 06.01.2020 12:31

Computers and Technology, 06.01.2020 12:31

History, 06.01.2020 12:31

History, 06.01.2020 12:31

Mathematics, 06.01.2020 12:31

Mathematics, 06.01.2020 12:31

Mathematics, 06.01.2020 12:31

Mathematics, 06.01.2020 12:31

History, 06.01.2020 12:31

English, 06.01.2020 12:31

History, 06.01.2020 12:31