Business, 08.07.2019 18:20 Chrisis9987

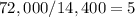

Milden company has an exclusive franchise to purchase a product from the manufacturer and distribute it on the retail level. as an aid in planning, the company has decided to start using a contribution format income statement. to have data to prepare such a statement, the company has analyzed its expenses and has developed the following cost formulas: cost cost formula cost of good sold $27 per unit sold advertising expense $184,000 per quarter sales commissions 7% of sales shipping expense ? administrative salaries $94,000 per quarter insurance expense $10,400 per quarter depreciation expense $64,000 per quarter management has concluded that shipping expense is a mixed cost, containing both variable and fixed cost elements. units sold and the related shipping expense over the last eight quarters follow: quarter units sold shipping expense year 1: first 30,000 $ 174,000 second 32,000 $ 189,000 third 37,000 $ 231,000 fourth 33,000 $ 194,000 year 2: first 31,000 $ 184,000 second 34,000 $ 199,000 third 44,400 $ 246,000 fourth 41,400 $ 222,000

Answers: 2

Another question on Business

Business, 21.06.2019 23:00

What is overdraft protection (odp)? a.) a cheap and easy way to always avoid overdrawing a bank account b.) a service to automatically transfer available funds from a linked account to cover purchases, prevent returned checks and declined items when you don’t have enough money in your checking account at the time of the transaction. c.) an insurance policy sold by banks to prevent others from withdrawing your money d.) a service provided by the government that insures individuals bank deposits up to $250,000

Answers: 2

Business, 22.06.2019 03:30

Lindon company is the exclusive distributor for an automotive product that sells for $30.00 per unit and has a cm ratio of 30%. the company’s fixed expenses are $162,000 per year. the company plans to sell 20,200 units this year. required: 1. what are the variable expenses per unit? (round your "per unit" answer to 2 decimal places.) 2. what is the break-even point in unit sales and in dollar sales? 3. what amount of unit sales and dollar sales is required to attain a target profit of $72,000 per year? 4. assume that by using a more efficient shipper, the company is able to reduce its variable expenses by $3.00 per unit. what is the company’s new break-even point in unit sales and in dollar sales? what dollar sales is required to attain a target profit of $72,000?

Answers: 2

Business, 22.06.2019 04:30

Peyton taylor drew a map with scale 1 cm to 10 miles. on his map, the distance between silver city and golden canyon is 3.75 cm. what is the actual distance between silver city and golden canyon?

Answers: 3

Business, 22.06.2019 07:30

Which two of the following are benefits of consumer programs

Answers: 1

You know the right answer?

Milden company has an exclusive franchise to purchase a product from the manufacturer and distribute...

Questions

Biology, 27.06.2019 05:30

Mathematics, 27.06.2019 05:30

Mathematics, 27.06.2019 05:30

Computers and Technology, 27.06.2019 05:30

Health, 27.06.2019 05:30

Mathematics, 27.06.2019 05:30

![\left[\begin{array}{ccc}&$Units&$Shipping Expense\\$High&44,400&246,000\\$Low&30,000&174,000\\$Diference&14,400&72,000\\\end{array}\right]](/tpl/images/0066/4976/d6f0d.png)