Business, 26.06.2019 04:40 demarcuswiseman

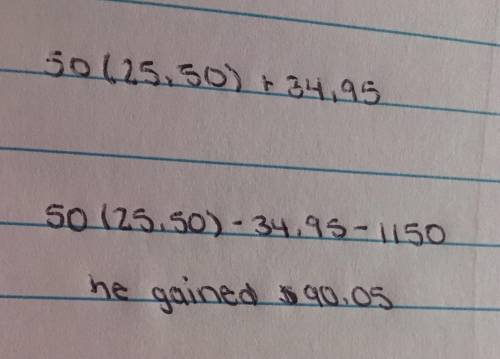

Jamal thomas paid a total of $1,150 for 50 shares of stock. he sold the stock for $25.50 a share and paid a sales commission of $34.95. what is the profit or loss from the sale?

Answers: 1

Another question on Business

Business, 21.06.2019 21:00

Resources and capabilities, such as interpersonal relations among managers and a firm's culture, that may be costly to imitate because they are beyond the ability of firms to systematically manage and influence are referred to asanswers: socially complex.causally ambiguous.path dependent.the result of unique historical conditions.

Answers: 3

Business, 21.06.2019 22:30

Before contacting the news or print media about your business, what must you come up with first ? a. a media expertb. a big budgetc. a track recordd. a story angle

Answers: 1

Business, 22.06.2019 00:00

Pettijohn inc. the balance sheet and income statement shown below are for pettijohn inc. note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over. balance sheet (millions of $) assets 2016 cash and securities $ 1,554.0 accounts receivable 9,660.0 inventories 13,440.0 total current assets $24,654.0 net plant and equipment 17,346.0 total assets $42,000.0 liabilities and equity accounts payable $ 7,980.0 notes payable 5,880.0 accruals 4,620.0 total current liabilities $18,480.0 long-term bonds 10,920.0 total debt $29,400.0 common stock 3,360.0 retained earnings 9,240.0 total common equity $12,600.0 total liabilities and equity $42,000.0 income statement (millions of $) 2016 net sales $58,800.0 operating costs except depr'n $54,978.0 depreciation $ 1,029.0 earnings bef int and taxes (ebit) $ 2,793.0 less interest 1,050.0 earnings before taxes (ebt) $ 1,743.0 taxes $ 610.1 net income $ 1,133.0 other data: shares outstanding (millions) 175.00 common dividends $ 509.83 int rate on notes payable 1. what is the firm's current ratio? (points : 6) 0.97 1.08 1.20 1.33 2. what is the firm's quick ratio? (points : 6) 0.49 0.61 0.73 0.87 3. what is the firm's total assets turnover? (points : 6) 0.90 1.12 1.40 1.68 4. what is the firm's inventory turnover ratio? (points : 6) 4.38 4.59 4.82 5.06 5. what is the firm's debt ratio? (points : 6) 45.93% 51.03% 56.70% 70.00% 6. what is the firm's roa? (points : 6) 2.70% 2.97% 3.26% 3.59% 7. what is the firm's roe? (points : 6) 8.54% 8.99% 9.44% 9.91%

Answers: 2

Business, 22.06.2019 00:30

Salty sensations snacks company manufactures three types of snack foods: tortilla chips, potato chips, and pretzels. the company has budgeted the following costs for the upcoming period: 1 factory depreciation $33,782.00 2 indirect labor 84,456.00 3 factory electricity 8,446.00 4 indirect materials 40,356.00 5 selling expenses 26,900.00 6 administrative expenses 17,200.00 7 total costs $211,140.00 factory overhead is allocated to the three products on the basis of processing hours. the products had the following production budget and processing hours per case: budgeted volume (cases) processing hours per case tortilla chips 3,600 0.25 potato chips 5,300 0.11 pretzels 2,300 0.49 total 11,200 required: a. determine the single plantwide factory overhead rate.* b. use the factory overhead rate in (a) to determine the amount of total and per-case factory overhead allocated to each of the three products under generally accepted accounting principles. refer to the amount descriptions list provided for the exact wording of the answer choices for text entries.* * if required, round your answers to the nearest cen

Answers: 1

You know the right answer?

Jamal thomas paid a total of $1,150 for 50 shares of stock. he sold the stock for $25.50 a share and...

Questions

Social Studies, 01.09.2019 01:20

Biology, 01.09.2019 01:20

Mathematics, 01.09.2019 01:20

Mathematics, 01.09.2019 01:20

Mathematics, 01.09.2019 01:20

Spanish, 01.09.2019 01:20

Social Studies, 01.09.2019 01:30

Computers and Technology, 01.09.2019 01:30