Business, 03.07.2019 12:00 ImmortalEnigmaYT

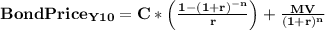

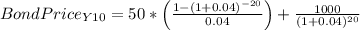

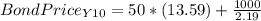

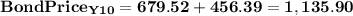

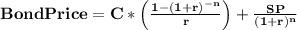

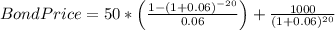

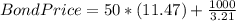

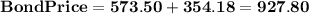

An investor is contemplating the purchase of a 20-year bond that pays $50 interest every six months. the investor plans to hold the bond only for 10 years, at which time she will sell it in the marketplace. she requires a 12 percent annual return but believes the market will require only an 8 percent return when she sells the bond 10 years from now. assuming she is a rational investor, how much should she be willing to pay for the bond today

Answers: 1

Another question on Business

Business, 22.06.2019 09:40

As related to a company completing the purchase to pay process, is there an accounting journal entry "behind the scenes" when xyz company pays for the goods within 10 days of the invoice (gross method is used for discounts and terms are 2/10 net 30) that updates the general ledger?

Answers: 3

Business, 22.06.2019 16:30

Penelope summers received certain income benefits in 2018. she received $1,400 of state unemployment insurance benefits, $2,000 from a federal unemployment trust fund and $3,700 workers’ compensation received for an occupational injury. what amount of the compensation must penelope include in her income

Answers: 1

Business, 23.06.2019 06:40

Acollege career counselor working at a community college is part of what career area? a. administration b. professional support services c. teaching and training d. guidance counseling

Answers: 2

You know the right answer?

An investor is contemplating the purchase of a 20-year bond that pays $50 interest every six months....

Questions

Mathematics, 03.12.2020 22:20

Mathematics, 03.12.2020 22:20

Advanced Placement (AP), 03.12.2020 22:20

Physics, 03.12.2020 22:20

Mathematics, 03.12.2020 22:20

World Languages, 03.12.2020 22:20

Mathematics, 03.12.2020 22:20

Biology, 03.12.2020 22:20

Social Studies, 03.12.2020 22:20

Mathematics, 03.12.2020 22:20

Mathematics, 03.12.2020 22:20

Mathematics, 03.12.2020 22:20