Business, 11.07.2019 07:00 pineappledogpie1608

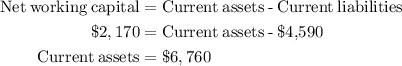

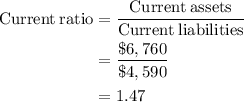

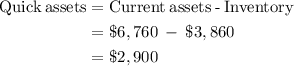

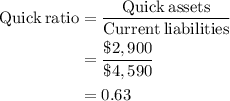

Dj, inc., has net working capital of $2,170, current liabilities of $4,590, and inventory of $3,860. a. what is the current ratio? (do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.) b. what is the quick ratio? (do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.)

Answers: 1

Another question on Business

Business, 21.06.2019 18:30

Beta coefficients and the capital asset pricing model personal finance problem katherine wilson is wondering how much risk she must undertake to generate an acceptable return on her porfolio. the risk-free return currently is 4%. the return on the overall stock market is 14%. use the capm to calculate how high the beta coefficient of katherine's portfolio would have to be to achieve a portfolio return of 16%.

Answers: 2

Business, 22.06.2019 05:30

Suppose jamal purchases a pair of running shoes online for $60. if his state has a sales tax on clothing of 6 percent, how much is he required to pay in state sales tax?

Answers: 3

Business, 22.06.2019 06:00

According to herman, one of the differences of managing a nonprofit versus a for-profit corporation is

Answers: 1

Business, 22.06.2019 12:40

Acompany has $80,000 in outstanding accounts receivable and it uses the allowance method to account for uncollectible accounts. experience suggests that 6% of outstanding receivables are uncollectible. the current credit balance (before adjustments) in the allowance for doubtful accounts is $1,200. the journal entry to record the adjustment to the allowance account includes a debit to bad debts expense for $4,800. true or false

Answers: 3

You know the right answer?

Dj, inc., has net working capital of $2,170, current liabilities of $4,590, and inventory of $3,860....

Questions

Chemistry, 25.10.2019 07:43

Geography, 25.10.2019 07:43

Mathematics, 25.10.2019 07:43

English, 25.10.2019 07:43

Biology, 25.10.2019 07:43

History, 25.10.2019 07:43

Chemistry, 25.10.2019 07:43

Mathematics, 25.10.2019 07:43

Mathematics, 25.10.2019 07:43

Mathematics, 25.10.2019 07:43

Mathematics, 25.10.2019 07:43

History, 25.10.2019 07:43

Mathematics, 25.10.2019 07:43

= 1.47

= 1.47

= 0.63

= 0.63