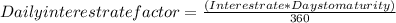

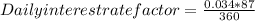

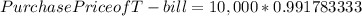

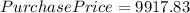

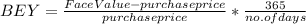

At-bill with face value $10,000 and 87 days to maturity is selling at a bank discount ask yield of 3.4%. a. what is the price of the bill? (use 360 days a year. do not round intermediate calculations. round your answer to 2 decimal places.) price of the bill $ b. what is its bond equivalent yield? (use 365 days a year. do not round intermediate calculations. round your answer to 2 decimal places.) bond equivalent yield %

Answers: 1

Another question on Business

Business, 22.06.2019 11:30

Consider derek's budget information: materials to be used totals $64,750; direct labor totals $198,400; factory overhead totals $394,800; work in process inventory january 1, $189,100; and work in progress inventory on december 31, $197,600. what is the budgeted cost of goods manufactured for the year? a. $1,044,650 b. $649,450 c. $657,950 d. $197,600

Answers: 3

Business, 22.06.2019 14:40

You are purchasing a bond that currently sold for $985.63. it has the time-to-maturity of 10 years and a coupon rate of 6%, paid semi-annually. the bond can be called for $1,020 in 3 years. what is the yield to maturity of this bond?

Answers: 2

Business, 22.06.2019 17:00

You hold a diversified $100,000 portfolio consisting of 20 stocks with $5,000 invested in each. the portfolio's beta is 1.12. you plan to sell a stock with b = 0.90 and use the proceeds to buy a new stock with b = 1.50. what will the portfolio's new beta be? do not round your intermediate calculations.

Answers: 2

Business, 23.06.2019 00:00

Match each economic concept with the scenarios that illustrates it

Answers: 2

You know the right answer?

At-bill with face value $10,000 and 87 days to maturity is selling at a bank discount ask yield of 3...

Questions

Mathematics, 20.08.2019 00:00

Mathematics, 20.08.2019 00:00

Mathematics, 20.08.2019 00:00

Business, 20.08.2019 00:00

History, 20.08.2019 00:00

English, 20.08.2019 00:00

History, 20.08.2019 00:00

Arts, 20.08.2019 00:00

Mathematics, 20.08.2019 00:00

Mathematics, 20.08.2019 00:00

Mathematics, 20.08.2019 00:00