Business, 14.07.2019 11:30 madisonnxo

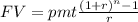

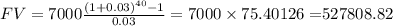

Ican't find the answerderek established his own retirement account 10 years ago. he has discovered that he can obtain a better rate for the next 10 years at 12 percent interest compounded semiannually. consequently, derek established a new ordinary annuity account (beginning amount $0.00) and he will contribute $7,000.00 semiannually into the account for the next 10 years. what will be the value of this account at the end of the 10-year period? a)$83,652.59b)$257,502.00c)$244,707 .61d)$264,501.86

Answers: 2

Another question on Business

Business, 22.06.2019 11:00

Your debit card is stolen, and you report it to your bank within two business days. how much money can you lose at most? a. $500 b. $25 c. $50 d. $150

Answers: 2

Business, 22.06.2019 11:40

Manipulation manufacturing's (amm) standards anticipate that there will be 5 pounds of raw material used for every unit of finished goods produced. amm began the month of maymay with 8,000 pounds of raw material, purchased 25,500 pounds for $ 15,300 and ended the month with 7,400 pounds on hand. the company produced 4,9004,900 units of finished goods. the company estimates standard costs at $ 1.10 per pound. the materials price and efficiency variances for the month of maymay were:

Answers: 1

Business, 22.06.2019 12:10

The cost of the beginning work in process inventory was comprised of $3,000 of direct materials, $10,000 of direct labor, and $10,000 of factory overhead. costs incurred during the period were comprised of $15,000 of direct materials costs, and $100,000 of conversion costs. the equivalent units of production (eup) for the period were 9,000 for direct materials and 6,000 for conversion. the costs per eup were:

Answers: 3

Business, 22.06.2019 12:30

Acorporation a. can use different depreciation methods for tax and financial reporting purposes b. must use the straight - line depreciation method for tax purposes and double declining depreciation method financial reporting purposes c. must use different depreciation method for tax purposes, but strictly mandated depreciation methods for financial reporting purposes d. can use straight- line depreciation method for tax purposes and macrs depreciation method financial reporting purposes

Answers: 2

You know the right answer?

Ican't find the answerderek established his own retirement account 10 years ago. he has discovered t...

Questions

Mathematics, 03.08.2019 06:10

Spanish, 03.08.2019 06:10

Spanish, 03.08.2019 06:10

Computers and Technology, 03.08.2019 06:10